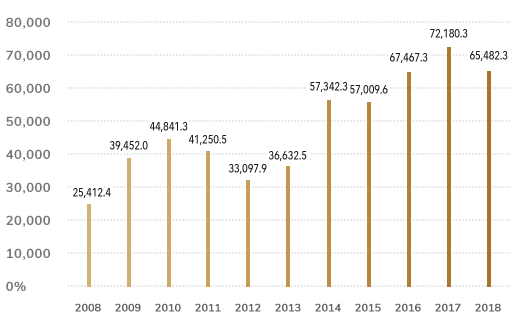

TOTAL CORPORATE BONDS IN THOUSANDS ILS

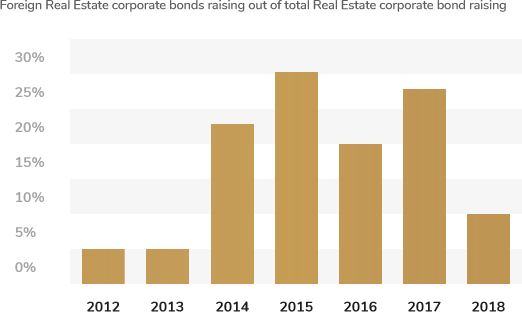

Orion is the leading underwriting firm in issuing corporate bonds for US based real estate companies in the Israeli capital market.

Since 2008, the Orion team has completed debt offerings in private and public issuances of over 8 billion ILS for US based real estate companies.

In these years, over 30 US real estate companies have found the Israeli capital market as an appealing arena for offering unsecured corporate debt in attractive terms.